It’s intuitive that housing market conditions would have a close relationship with credit flows; when funds are flowing freely and rates are low, home buyers and investors step up their presence in the housing market and when credit is harder to come by or more expensive, things slow down.

Story: Tim Lawless – Corelogic

Since 2015, things have become a bit more complex, and the correlation between dwelling value appreciation and housing credit has become tighter; especially when measured against investment credit.

Since macro prudential measures were announced and implemented by APRA, the trends in housing related credit have changed remarkably. Soon after APRA announced the ten percent annual speed limit for investment lending in December 2014, investment housing finance commitments peaked at 55% of mortgage demand and investment credit growth moved through a cyclical peak rate of annual growth at 10.8%. Around the same time, the quarterly rate of home value appreciation peaked in Sydney and Melbourne; the two cities where investment has been most concentrated.

As credit policies were tightened in response to the APRA limits, then loosened as lenders overachieved their APRA targets, the housing market responded virtually in concert. Interest rate cuts in May and August of 2016 helped to support a rebound in the pace of capital gains, however as lenders came close to breaching the 10% limit, at least on a monthly annualised basis, credit once again tightened and the second round of macro prudential, announced in March 2017, saw credit availability restricted further.

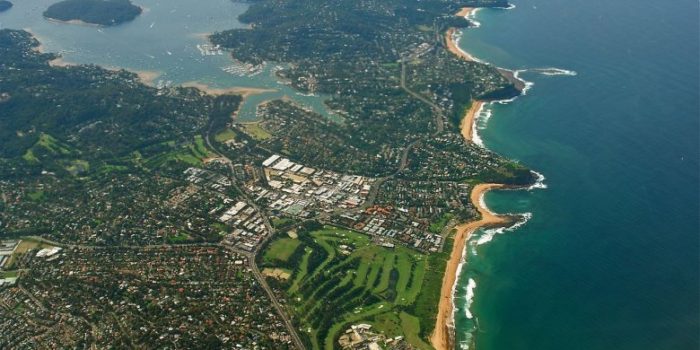

The result of changes in credit availability has been evident across most housing markets, but is very clear in Sydney and Melbourne; dwelling values started to track lower in Sydney from July last year and peaked in Melbourne in November last year.

More recently, there are some early signs that Sydney’s housing market is already achieving a soft landing, probably earlier than expected. The monthly rate of decline has eased from 0.9% in December and January to reach 0.6% in February and 0.3% in March. The easing rate of decline comes as investment credit flows have ticked up a notch and some lenders have announced a reduction in the mortgage rate premiums being paid by investors and interest only borrowers.

Whether the improvement in Sydney’s housing market is temporary or not will be largely dependent on credit policies. It’s hard to imagine any lender would be aggressively ramping up their share of investment loans, despite the fact that APRA benchmarks have been so comprehensively achieved. Investment credit growth is currently tracking at just 2.8% per annum and interest only originations were tracking at around 15% in December last year; roughly half the 30% APRA benchmark. Despite over shooting the benchmarks, considering the Royal Commission is under way and there is a great deal of focus on lending practices, the likelihood is that investment related credit may step up a notch, but not likely enough to cause a sharp rebound in housing market conditions like what we saw through 2016.