Offset accounts explained and demystified…

So you may be considering making the move into your first property, or simply wanting to make your home loan work better for you. So what is an offset account and how does it benefit you?

Article By: Ben Benny

What is an offset account?

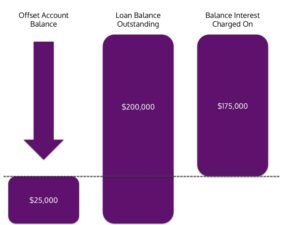

Quite simply – it’s a transaction account linked to an eligible home or investment loan. The money held in this account is offset against the money you owe on that loan, and you will only be charged the interest on the difference.

E.g if you have a $200k loan and $25k in the offset, you will only be charged interest on $175k.

Does it change how much you pay each installment?

Yes and No.

If you have an interest-only loan then yes, as you will be paying the offset interest amount only – so the more that sits in your offset, the lower your repayments will be.

If you have an interest and principal loan, you will pay the same installment amount, however you will be paying more off your principal loan amount. Therefor paying off your loan much faster.

So what are the negatives?

The obvious one is fees. Typically an offset loan package incurs fees of around $400 per annum. So it doesn’t make sense unless you keep more than $10,000 or more in your account (using todays 4% interest rate as an example – ie 4% of $10,000 = $400)

The other is having some self-discipline. Unlike when you make extra-repayments into your typical loan, when its in offset you can access this money anytime – and may be tempted to dive in and use the cash for something else. But then again, that is another benefit, having accessible funds for a rainy day or another investment opportunity.

So to summarise, an offset account makes a lot of sense for most home and investment loans – as long as you have more than $10,000 in your offset account you will be saving money and/or paying off your loan faster. Many people have their wages or any other income paid directly into the offset as it is calculated daily. The more you have in there, the more you will save!

If you need home loan advice, whether it be re-configuring your existing loan or getting ready for your first loan, contact our preferred mortgage broker Nick Press. With decades of industry experience Nick will have the right product for you.